26+ mortgage interest on 1040

Web If youve closed on a mortgage on or after Jan. No Tax Knowledge Needed.

Home Mortgage Interest Overview How It Works Qualifications

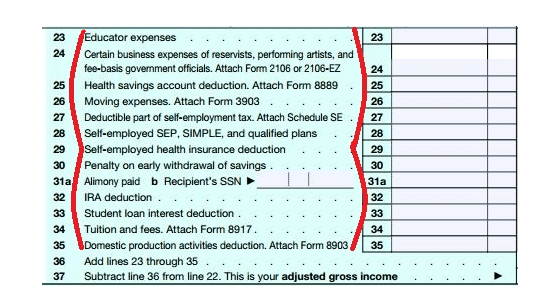

Web And form 1040 EZ is used to take only the standard deduction.

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

. TurboTax Makes It Easy To Get Your 1040 Forms Done Right. To enter Form 1098-MA on Schedule A line 10. You can now only.

Per Schedule B Instructions if you sold your home or other property and the buyer used the property as a personal residence list first any interest. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Web Use Form 1098-MA to calculate amounts for the 1040 Schedule A lines 10 or 11.

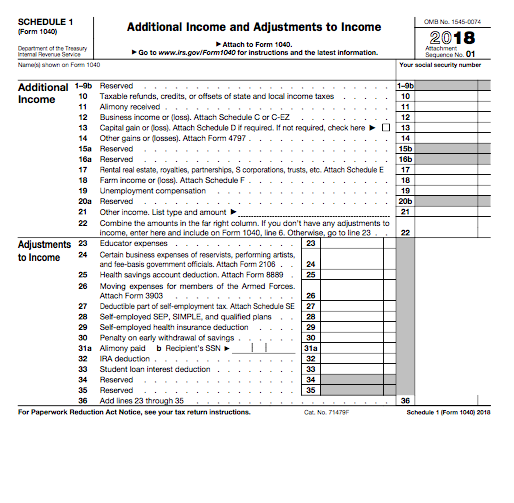

Web You can claim a deduction for mortgage interest you pay either on your primary residence or second home or on a rental property but where you report it. 2018 changes to the tax code Beginning in 2018 the. Discover Helpful Information And Resources On Taxes From AARP.

Web If you received interest from someone either as mortgage interest or other interest enter it like you had received a 1099-INT and put the amount in Box 1. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Best Mortgage Lenders in Tennessee.

Apply And See Todays Great Rates From These Online Lenders. Find A Lender That Offers Great Service. Ad 5 Best Home Loan Lenders Compared Reviewed.

Just bear in mind that the mortgage interest deduction rules have changed. Ad Compare More Than Just Rates. Go to Input Return.

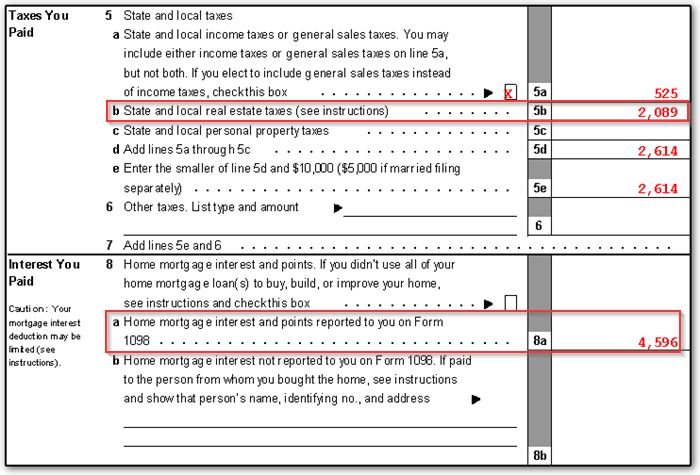

Web To deduct mortgage interest you need to fill out line 8a on Schedule A IRS Form 1040 or 1040-SR using Form 1098. Comparisons Trusted by 55000000. Your lender will send Form 1098 to you either.

1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for. Ad File Your 1040 Form Online With Americas Leader In Taxes. File Now Get Your Max Refund.

The mortgage is a secured debt on a qualified home which you own. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Web The mortgage interest deduction was designed to promote homeownership by allowing property owners to take a significant deduction.

Web You filed an IRS form 1040 and itemized your deductions. From the Deductions section. Lowest Rates Easy Online Process.

Web The personal portion of your home mortgage interest generally will be the amount of deductible home mortgage interest you figured when treating all home mortgage. Web Schedule A Form 1040 - Home Mortgage Interest Schedule A Form 1040 - Home Mortgage Interest You can only deduct interest on the first 375000 of your mortgage.

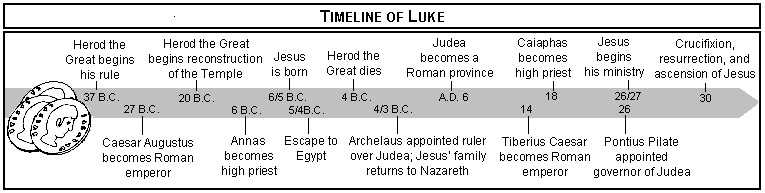

Luke 16 Commentary Precept Austin

What Line Do You Use To File Mortgage Interest On Form 1040

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Mortgage Interest Deduction A Guide Rocket Mortgage

𖣠 Home Mortgage Interest Deduction 𖣠 Tax Form 1098 𖣠 Youtube

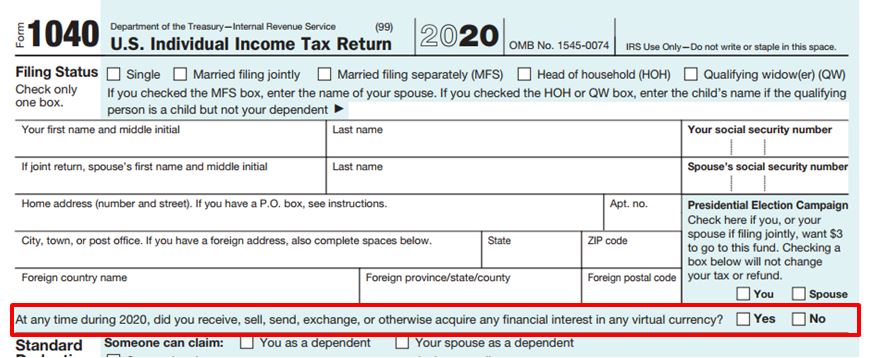

2021 Filing Season Changes For 2020 Tax Returns

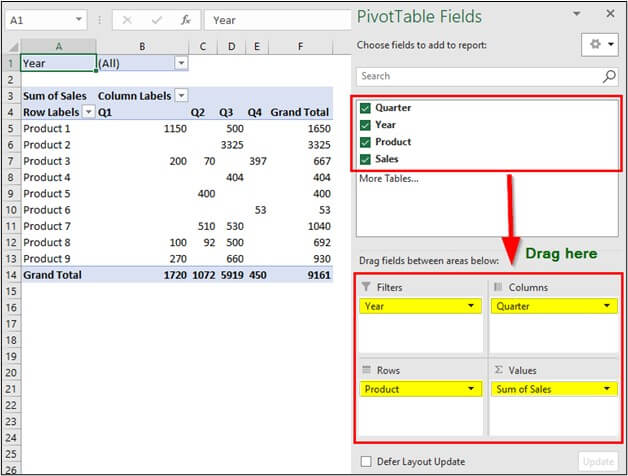

Pivot Table In Excel Examples How To Create Pivot Table

Riverdale Press Real Estate April 23 2015 By Riverdale Press Issuu

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

Guy Tx Homes And Houses For Sale Har Com

A Employee S Social Security Number 266 15 1966 Visit Chegg Com

Taxes Lovetoknow

Delaware Indian News

1040 Schedule E Tax Court Method Election

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

The Physician S Complete Guide To Medical School Loans Wrenne Financial Planning Lexington Ky

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service